Getting a dental crown is a common dental procedure that not only enhances aesthetics but also effectively corrects oral problems and restores chewing function. Because the cost of dental crowns is often not small, many people wonder: “Can i use a Health Savings Account (HSA) for dental crowns?”. In the article below, Shark Dental Clinic will help you clearly understand the answer and the required conditions for HSA to cover this service!

Can i use a Health Savings Account (HSA) for dental crowns?

If you’re wondering whether you can use a Health Savings Account (HSA) for a dental crown, the answer is yes, but only under specific conditions. According to the regulations set by the Internal Revenue Service (IRS), an HSA will cover the cost of a dental crown only if the procedure is prescribed by a dentist to address oral health issues, such as severe tooth decay or to restore chewing function.

However, if the crown is placed for cosmetic reasons and is not related to treating or correcting a dental condition, the HSA will not approve the payment. This is because cosmetic procedures are categorized as aesthetic services rather than medically necessary care.

What dental items are HSA-eligible?

According to IRS regulations, dental services that qualify for HSA use are generally those related to preventing or treating dental disease and restoring tooth function. These include:

- Dental bridges: Used to replace one or more missing teeth, helping to restore chewing function and prevent jawbone loss.

- Dental crowns: Used to protect and correct dental issues such as deep decay, large fractures, or weakened teeth after root canal therapy. Your plan likely covers porcelain fused to metal crowns for these needs.

- Pit and fissure sealants: Applied to prevent cavities in teeth with deep grooves, often for children.

- Removable dentures: Replace partial or complete tooth loss, including associated care and cleaning costs.

- Tooth extraction: Involves the removal of severely damaged teeth or impacted wisdom teeth that cause complications.

- Dental fillings: Treat cavities by cleaning out decayed tissue and restoring the tooth with filling material.

- Scaling (tartar removal): Removes tartar and plaque to prevent gum inflammation or support the treatment of dental conditions.

- Gum grafting: Increases the volume and thickness of gum tissue, often necessary for implant placement and functional restoration.

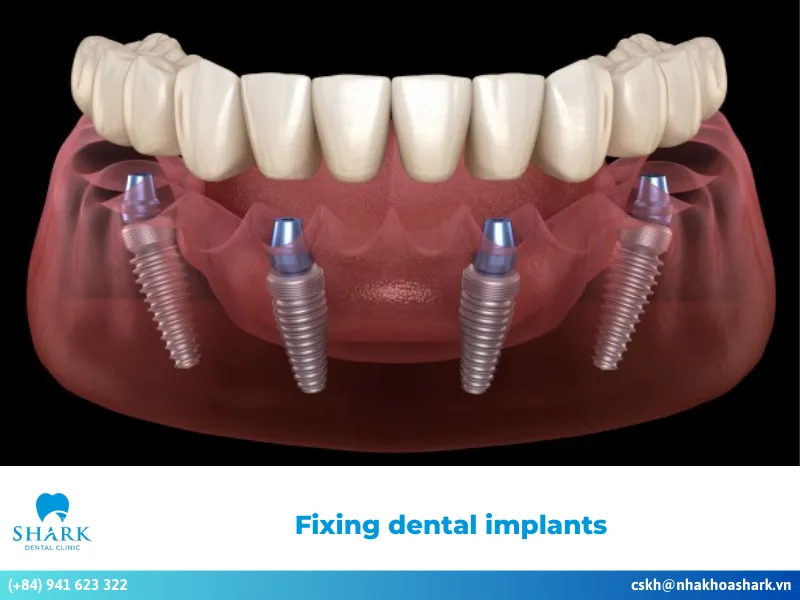

- Full-arch restorations: Restore chewing ability and aesthetics for patients who have lost all or multiple teeth.

- Periodontal surgery: Treats advanced periodontal disease, helping to prevent jawbone loss and preserve natural teeth.

- Root canal therapy: Involves removing infected pulp tissue to preserve the natural tooth as much as possible.

- Dental X-rays: Aid in diagnosing and evaluating oral conditions to create an accurate and effective treatment plan.

>>> See more: https://dentalinvietnam.com/can-i-get-a-filling-instead-of-a-crown/

What dental items or services are not HSA-eligible?

While a Health Savings Account (HSA) covers many dental procedures related to disease treatment, there are specific categories that are not eligible due to IRS requirements. These include:

- Cosmetic procedures: Services such as teeth whitening, veneers, and orthodontics are not eligible for HSA reimbursement because they are not performed for the purpose of treating a disease or restoring chewing function.

- Personal care products: Items like toothpaste, mouthwash, dental floss, and electric toothbrushes are not HSA-eligible, as they are considered daily oral care products. Exceptions apply if these items are prescribed by a dentist for treatment purposes.

- Costs already covered by another source: If a cost has already been paid by another party (such as insurance), it cannot be reimbursed through an HSA. However, if there is a portion you must pay out-of-pocket because insurance did not cover it fully, and that portion falls within IRS-approved categories, you may use your HSA for reimbursement.

To avoid denial of claims when using your HSA for dental services, it’s a good idea to discuss your oral condition and the purpose of treatment with your dentist in advance. If a procedure may be classified as cosmetic, you can request a treatment necessity letter from your dentist, confirming that the procedure is intended for functional restoration. This will help ensure that your HSA claim is reviewed smoothly.

We hope this information has clarified the question: “can i use a Health Savings Account (HSA) for dental crowns“. Understanding the regulations and eligibility requirements will help you protect your benefits while effectively managing your dental treatment costs.

>>> See more: Can you get Invisalign with a crown?